Things to Know About Subprime Car Loans

With the average transaction price of a new car hovering in the mid $30,000 range, financing has become more of a necessity. Very few people can just write a check for $30,000 and drive away smiling.

However, if you’re one of the 20 percent of Americans whose credit score falls between 580 and 669, you’ll be looking at one of the subprime car loans offered by a wide range of lenders.

While this isn’t necessarily a bad thing, there are some things to know about subprime car loans.

They Cost More

Borrowers classified as subprime will pay more for loans than those with higher credit ratings. Lenders perceive subprime car loans to be more of a risk, so they charge more for them in the form of higher interest rates. Ultimately, this means the car will be more expensive in the long run; but if it gives you considerable financial breathing room month to month, it might still be your best option.

Larger Down Payments

In most cases, subprime borrowers will also be looking at larger down payments. Lenders, while open to doing business with people who have had credit issues, try to minimize their exposure as much as possible. Requiring a larger down payment means the loan amount will be less. In some cases, this can be as much as 20 percent of the purchase price of the car.

Longer Terms/Higher Purchase Price

Getting back to that average transaction price for a moment; if you finance a $30,000 car with 20 percent down at four percent interest over three years your monthly payment will be $709.00 (before sales taxes are calculated). This brings the total price to $31,524. However, interest on subprime loans can run as high as 20 percent, which gives you a payment of $892 a month. To make that payment more affordable, some lenders are willing to push the term to as many as seven years. While this brings the payment down to $533 a month, it raises the price you’ll pay for the car to $50,772.

Shorter Leashes

Subprime lenders tend to be less tolerant of missed payments because they know it’s a slippery slope. Some are notoriously quick on the draw when it comes to repossession. Others have installed devices giving them the capability of rendering the car inoperable until payments are brought current. Though the legality of that practice is being debated, it shows the measures certain lenders will take to reduce their risk.

You Can Minimize These Issues

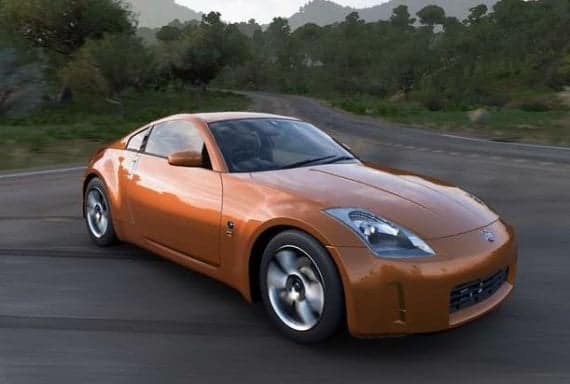

Check your credit score before you go shopping for a car. If you find yours is on the lower side, readjust your thinking in terms of the nature of your purchase. While you might want a brand new $30,000 Camry, a clean $15,000 used Camry would serve you better.

In addition to the lower payments, your insurance will be more affordable, and registration will be cheaper too. Remember, the higher the purchase price and the longer the loan term, the more you’ll pay to drive the car. Plus, you’re setting yourself up for all of the other things to know about subprime loans listed above.

While you will absolutely find a dealer willing to sell you the new car, it’s up to you to be realistic about your situation and make the smart play. Even if you can afford the payment, there are far better uses for your money if you’re in the subprime category. Buy smart, use the leftover money to clean up your credit and your next purchase can be what you really want—at more favorable terms.